The IRS raised the cap on 401(k) contributions $500 to $19,500. People 50 and older can contribute an additional $6500 as part of their catch-up contributions. That’s also $500 more than last year. One incentive to save is that traditional pre-tax contributions to a 401(k) can reduce your adjusted gross income or taxable income.

The key to taking advantage of this rule is to make sure that you are contributing the maximum amount allowable to your retirement plans.

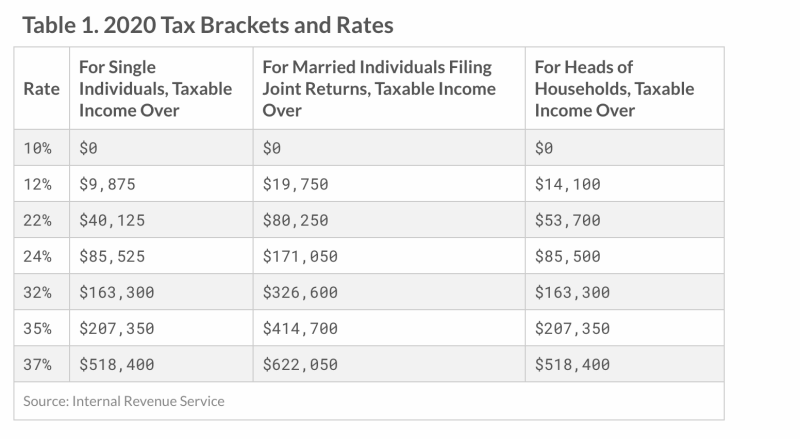

The IRS released its inflation adjusted personal tax brackets for 2020 at the end of last year. This Tax Foundation chart helps you determine your federal tax bracket based on the income you will earn in 2020.

For 2020, the IRS has increased the standard deduction by $400 for married couples filing jointly to $24,800. The standard deduction for single taxpayers increased $200 and rose to $12,400. For heads of households, the standard deduction will be $18,650 for tax year 2020, up $300.

Tax Refunds

The IRS issued 111,596,000 refunds in 2019. That was about 300,000 fewer than it issued in 2018. The average refund check in 2019 was $2,860, down slightly from the average $2,899 refunded in 2018.